The uses of Artificial Intelligence in Banking are to process high-speed data and get valuable insights. Furthermore, technologies like contactless banking, AI bots, and biometric fraud prevention systems contribute to higher-quality services for a more extensive consumer base. Computer Vision, Language Processing, Optimization Techniques, Vision, Audio, Planning, Robotics, and other technologies are examples of artificial intelligence.

Artificial Intelligence is the way to go in today’s world. AI has been around for quite some time. AI was initially proposed as a discipline of computer science in 1955 to create “intelligent machines,” or machines that could emulate the cognitive powers of the human brain, such as understanding and problem-solving.

What is Artificial Intelligence?

The replication of human intellectuality is AI, known as artificial intelligence technology. Knowledge-based systems, language processing, speech recognition, and machine vision are examples of AI applications.

AI systems generally consume vast volumes of labeled training data, collect data for connections and patterns, and then use these styles to forecast future stats. By examining millions of instances, a chatbot given samples of text chats may learn to make lifelike dialogues with humans. In contrast, an image recognition program can learn to recognize and describe items in photographs. The market is using artificial intelligence specifically on the three cognitive functions that AI programming focuses on, learning, reasoning, and self-correction.

Uses of Artificial Intelligence in Banking

sBanks are exploring ways to incorporate AI technology into their business to enhance the customer experience, reduce operational costs, and increase service quality. AI can be deployed in various areas, including the front office, middle office, and back office. These improvements will enhance the overall experience and help improve customer satisfaction and loyalty.

Artificial intelligence-powered systems can process enormous amounts of data rapidly and effectively. They can manage unstructured and structured data in ways beyond human capacity. They can use this data to analyze past risk cases and predict problems for the future. AI-powered systems can monitor customer behavior and identify unusual behavior, such as changing locations or buying certain products. They can also activate a security feature when a suspicious transaction is detected, preventing potential fraud.

AI-powered systems are used to automate the processes of banking. For example, conversational AI can handle up to 50% of customer service requests while reducing the bank’s workforce costs by up to 20 percent. Banks can leverage AI to understand their customers’ preferences and choices better. They can increase customer satisfaction and retention rates by analyzing customer preferences and choosing the best solution based on this information.

AI-powered systems can also help banks detect fraudulent and suspicious behavior. By automating processes and detecting suspicious patterns, AI-powered systems can detect fraudulent transactions and detect anti-money laundering tendencies. AI-powered systems can also make recommendations to customers based on their behavior.

Artificial Intelligence sector and banking

AI helps banks forecast potential results and trends by evaluating previous behavior and predicting future situations by implementing machine learning in banking. This assists banks in detecting fraud, detecting anti-money laundering patterns, and providing consumer suggestions. Even conventional banks have begun to provide more online services. Artificial intelligence helps them to simplify business operations, make better judgments, and manage customer support demands with less staff.

The future AI-powered banking organization will be able to enhance back-office operations, decision-making, and innovation by leveraging data to generate intelligently tailored and multichannel experiences. Global digital banking customers are estimated to exceed 3.6 billion by 2024. The statistic isn’t unexpected because it simply confirms what institutions and the rest of the world know.

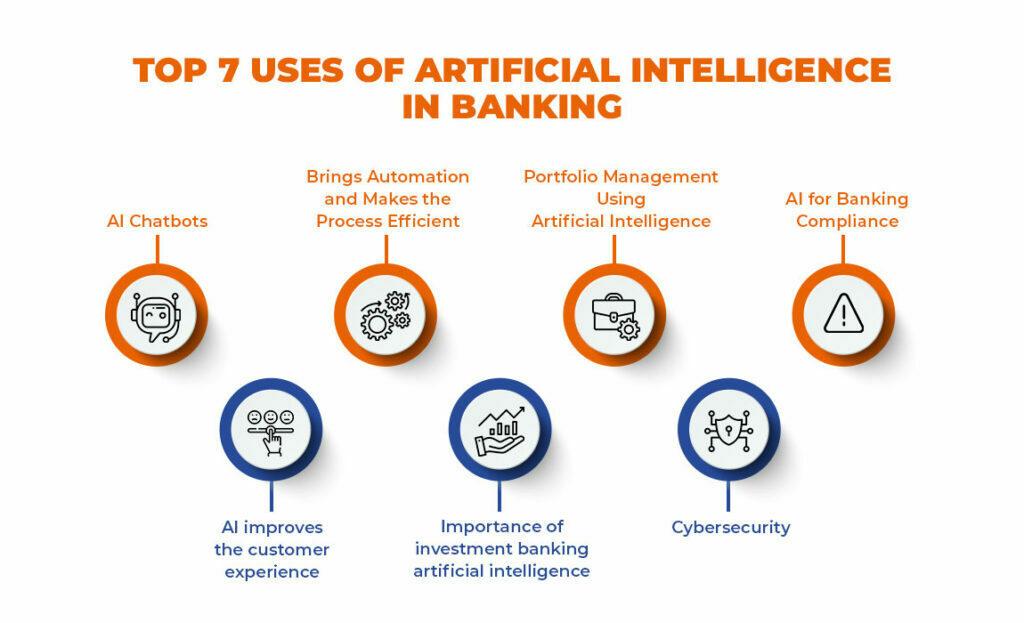

Top 7 Uses of Artificial Intelligence in Banking

1. AI Chatbots

AI Chatbots are one of the most significant benefits of utilizing AI technology in banking. AI banking chatbots assist clients in a variety of ways. AI-based chatbot service is one of the critical use cases in the banking business. Artificial intelligence bots in banking are revolutionizing the way organizations assist their clients.

AI chatbots in the banking business may serve consumers 24 hours a day, seven days a week, and provide correct answers to their questions. In addition, these chatbots offer users a customized experience. As a result, chatbots for bank and financial operations enable banks to grab client attention, improve service quality, and grow their brand’s market presence.

2. AI improves the customer experience

AI banking apps have the potential to transform the finance industry. The goal of AI apps for mobile banking for Android/iOS is to improve experiences for customers and quality of service. Machine learning artificial intelligence implementation in banking assists organizations track user activity and provides more tailored services to clients.

Intelligent mobile apps that utilize machine learning algorithms may monitor user activity and draw important information from search trends. This information will assist service providers in making customized suggestions to end customers.

As a result, 70% of banks plan to integrate AI into mobile banking applications and seize the golden potential AI presents in the banking industry. Organizations state that through artificial intelligence, customer experience has been great and has a ton of potential in upcoming years.

3. Brings Automation and Makes the Process Efficient

Using machine learning artificial intelligence in banking will speed automation and make your process more fluid. Automation is one of the most compelling AI use cases in the finance and banking sectors. As a result, AI has enormous promise in the banking business. AI software assists banks in simplifying and automating every operation performed by people, making the entire procedure simple and virtual.

As a result, AI solutions can cut bankers’ workload while improving work quality. In addition, users may request services anytime and receive correct replies from AI virtual banking associates using customized AI banking applications and AI chatbot services.

4. Importance of investment banking artificial intelligence

Machine learning in Investment banking is an absolute necessity because, without that, the high-stakes investments are always in fear of falling through due to the lack of adaptation to newer methods and thorough research. Machine learning artificial intelligence may be widely employed across the front, middle, and back-office operations in high-stakes investment banking and across numerous asset classes where richer and predictive data may improve decision-making processes.

Moreover, the chances to enhance risk management practices, provide value for clients, and increase the reliability of actions will enhance growth because its investors are expanding by the day. Investment banks, in a fiercely competitive business, may leverage cognitive tools and decision-making technologies to enhance every aspect of the transaction lifecycle. Whether via the development of structured products, the projection of value at risk, the forecasting of income on capital, or the enhancement of accurate and timely decision making.

5. Portfolio Management Using Artificial Intelligence

It is one of the most significant AI benefits in the banking and finance business. Artificial intelligence can help with income and portfolio management more effectively. New technology has indeed brought everything to our fingertips. AI assists users who are unable to visit banks regularly. Digital banks use ai in banking reports to track your withdrawals and inputs and monitor them consistently to provide an accurate return for the customer.

This cutting-edge AI technology can handle financial services and improve mobile banking operations. When sending money via digital banking applications, AI programs will follow and provide consumers quick transaction notifications if any questionable transactions are detected. AI machines promptly notify the user. As a result, AI assures secure transactions.

6. Cybersecurity

By utilizing data from prior threats and understanding patterns and signs that appear unrelated to forecasting and preventing assaults, AI may significantly increase the efficacy of cybersecurity systems. In addition to mitigating external risks, AI may analyze domestic threats or breakdowns and recommend corrective steps, resulting in data theft and abuse prevention.

7. AI for Banking Compliance

Uses of Artificial Intelligence in Banking is becoming increasingly popular in banking. The largest corporations favour companies that follow compliance requirements guidelines. Under current compliance laws and regulations, the banking sector must constantly upgrade its work procedures. Most banks have a compliance management team for this reason.

Machine learning uses software-based apps to fulfill requirements, and the compliance teams sanitize web pages and other internal documentation. Unfortunately, doing this procedure manually takes a long time and requires more cash. Artificial intelligence-based software applications may actively seek out and comply with the laws that apply to banks. In addition, AI software improves compliance officers’ skills and helps them to grow their operations.

The Final Words

The Uses of Artificial Intelligence in Banking empowers you to increase consumer interaction, inspire customer loyalty, and improve retention. Here, we offer our recent experience presenting AI to business people and the lessons we learned along the road. As AI banking believers, we take an awareness marketing strategy.

Here are the three main points we intended to convey:

- Those that do not adopt AI will be swept away by rivals and entrants who do.

- AI-analyzed documents include document processing solutions that people now conduct can be automated. Business process automation in general

- Unlock the potential of your data to create AI systems that enhance key performance indicators (KPIs) like revenue, quality, and expenses to monetize your data.

FAQ

1. What role may artificial intelligence play in assisting customers?

Artificial intelligence assists in analyzing consumer data and important metrics and recommending items or services to clients based on their web surfing habits. AI can analyze massive data sets, derive information such as temperature and location, and recommend appropriate content to clients.

2. Why must banks be the first to use AI?

To compete and prosper, banking institutions must become “AI-first” institutions, embracing AI technology as the cornerstone for unique value propositions and unique and differentiated client experiences.

3. Will banks be able to face the AI challenge?

Digital banking use cases for machine learning to make it smooth and function systematically. Artificial intelligence technologies are becoming increasingly important in our world, and banks must employ artificial intelligence technology at scale to remain competitive. A thorough change spanning various organizational layers is required for success.